Market

1658750380.jpg)

Nepal's streets now have more Electric Vehicles (Evs) than ever before - as the country imported a record number of electric vehicles in the previous fiscal year thanks in large part to the government's decision to abolish excise duty and slash customs duty on imports of electric vehicles.

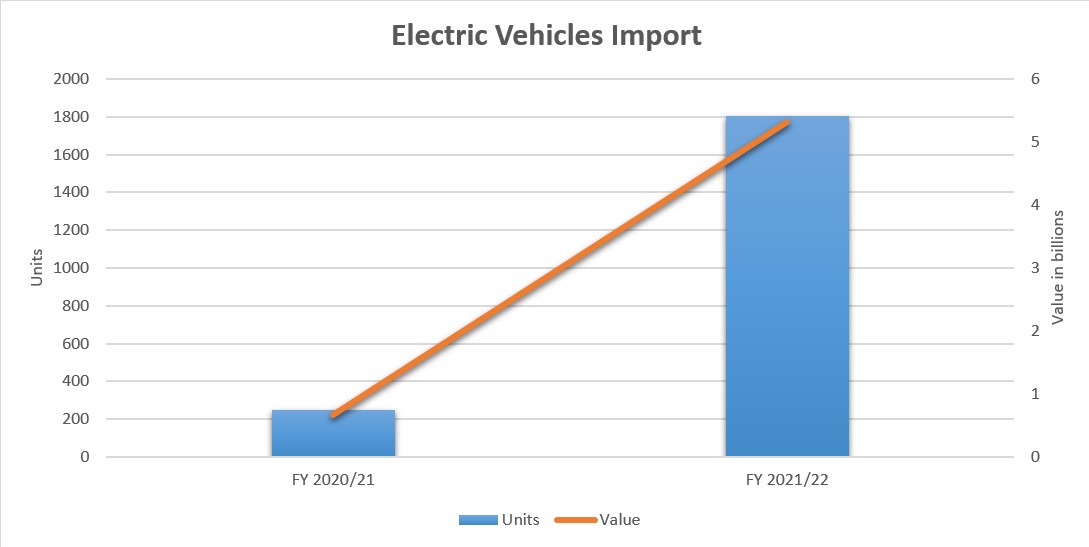

Nepal imported 1,807 units of electric cars and jeeps worth Rs 5.32 billion in the fiscal year 2021/22 - a jump of 709 percent over the previous fiscal year. Nepal had imported 249 units of electric cars & jeeps worth Rs 0.657 billion in FY 2020/21.

The federal budget of 2021/22 slashed import duty on battery-powered autos from 40 to 10 percent to increase electricity use and transition towards environment-friendly transportation.

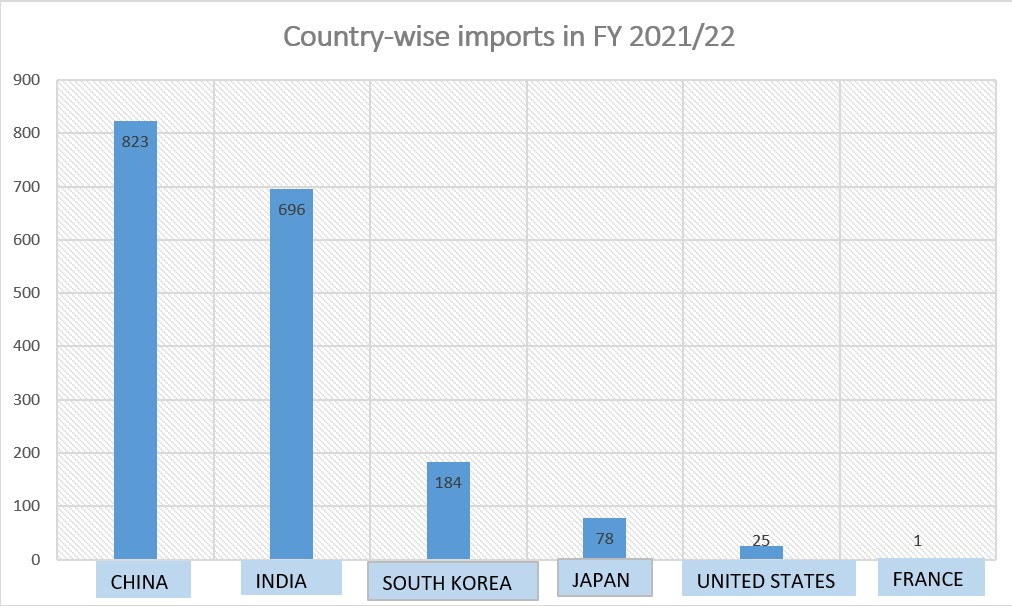

The annual foreign trade statistics issued by the Department of Customs show Nepal imported electric cars & jeeps mainly from six countries - India, China, South Korea, the United States, Japan, and France.

In FY 2021/22, the highest number of electric vehicles came to Nepal from China. Nepal imported 823 units of electric vehicles worth Rs 2.45 billion from China. Similarly, the country imported 696 electric vehicles worth Rs 1.73 billion from India.

Revenues

Last year, the government collected revenues worth Rs 1.43 billion from electric vehicle imports.

In the last fiscal, 996 units of electric vehicles of up to 100 kW capacity were imported. Similarly, 792 units of electric cars from 100 kW to 200 kW; 13 units from 100 kW to 150 kW; two units up to 300 kW; and four units from 200 kW to 300 kW were also imported in 2021/22.

Nepali automobile traders have been importing US-based brand Tesla, European brands like Audi, Jaguar, MG (now Chinese owned), Peugeot; Korean brand Hyundai and Kia; Japanese brand Nissan; and Indian brand Tata into the Nepali market.

Though the imports of electric vehicles surged exponentially in the last fiscal, the same cannot be said about the current fiscal. The reason is that the government, in the FY 2022/23 federal budget, has levied excise duty on top of the existing customs duty on electric vehicles above 100 kW capacity.

This, according to automobile importers, will make electric vehicles costlier.

As per the new Finance Bill, the government has imposed a 30 percent excise duty on vehicles with 100-200 kW motors. Similarly, the government has imposed a 45 percent excise duty on importing electric vehicles with electric motors of 201-300 kW capacity. Excise duty has been maintained at 60 percent on electric vehicles with a more than 300 kW motor capacity.