Science & Technology

On September 15, cryptocurrency enthusiasts across the world jumped in collective joy as the news broke out confirming ‘The Merge’.

Heck, what exactly is this Merge?

It’s about Ethereum, the second most valuable ‘blockchain’ after Bitcoin, changing its mode of operation to become less energy-intensive in a context of rapid growth. This is, as those in the know put it, the most-ambitious software upgrade yet in the cryptocurrency world that could fuel more usage of the commercial blockchain.

Blockchain explained

All cryptos work on blockchain technology. As Adam Hayes writes in a 2022 article in Investopedia: “A blockchain is a distributed database or ledger that is shared among the nodes of a computer network.”

A block in a blockchain is a record of transactions of a certain size. Once the size is reached, a new block is added to the previously created block like a chain.

The blockchain technology helps to validate the transaction in a network like Bitcoin and Ethereum, and cuts the middleman like banks to keep the records of transactions.

Not only does the Ethereum blockchain technology support cryptocurrencies like Ether but it also backs digital goods like NFTs (Non-Fungible Tokens).

Proof-of-work vs proof-of-stake

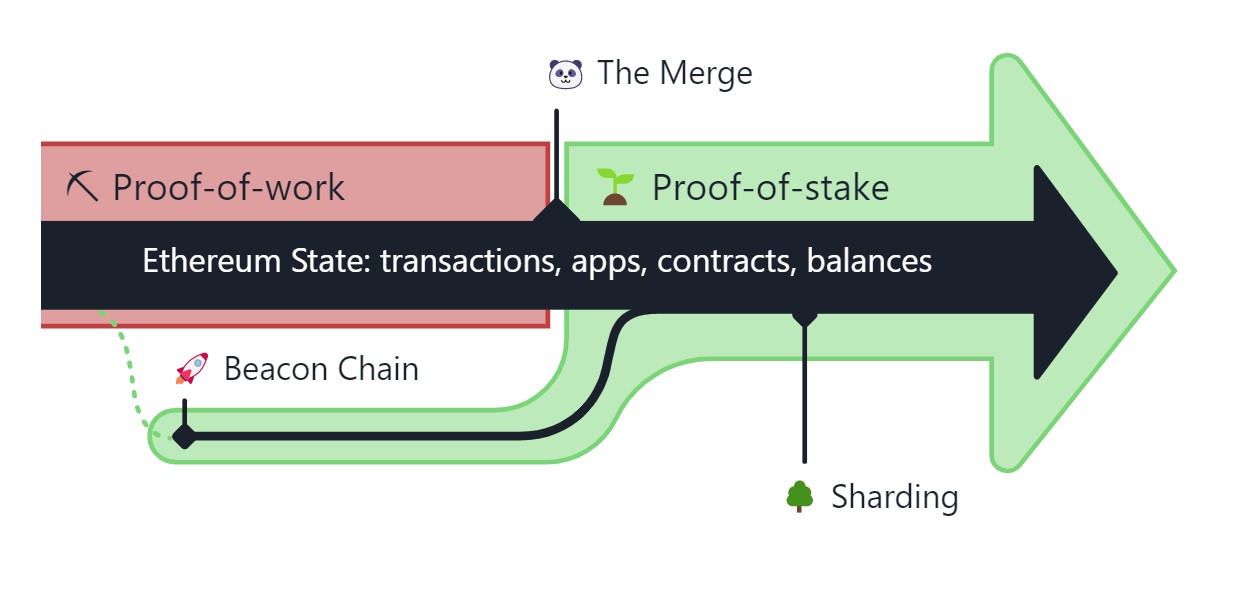

Until now, the Ethereum blockchain had been using a “proof-of-work” model, similar to the Bitcoin blockchain. Any transaction would take place and validated only when miners crunch complex mathematical problems. This process requires a lot of computational power and a huge amount of electricity.

Powerful computers connected to the network across the world compete to crunch mathematical problems. The computer that cracks a problem is then rewarded with a crypto token in a process called mining.

Proof-of-work model requires work to give credibility to the transactions. Consequently, the crypto adoption consumes a huge amount of electricity.

According to Statista, the world consumes 24,000 TWh (terawatt-hours) of electricity. The Bitcoin blockchain chews up about 0.85 per cent of that 204 TWh and Ethereum 85 TWh (about 0.35 per cent).

In contrast, Nepal used 6.62 TWh of electricity in 2019, according to the International Energy Agency (IEA). That suggests Ethereum consumes nearly 13 times more electricity than the whole of Nepal.

Now with this merger, Ethereum will shift to the proof-of-stake model which consumes 99.95 percent less electricity than it does today.

Confirming the long-awaited network revamp on September 15, Ethereum creator Vitalik Buterin tweeted: “The merge will reduce the worldwide electricity consumption by 0.2 per cent.”

The merger saw Ethereum joining forces with an identical network called Beacon, which had been running for years as a test for the proof-of-stake model.

As a result, a lot of Ether will be taken out of supply to be stored as a ‘stake’ to validate the transactions. People who put their Ether as a stake will be rewarded with Ether similar to interest at banks. Pulling out of supply also means Ether has a high probability to rally upward or at least outperform other cryptocurrencies.

Crypto enthusiasts hope this will reduce what they call the ‘gas fee’ [transaction service charge] of the network, making the Ethereum network greener. Its hodlers believe a financial instrument-like working mechanism, coupled with low energy consumption, ether is the future of cryptocurrency.

Still no no in Nepal

Cryptocurrencies are currently banned in Nepal.

The Nepal Rastra Bank, which regulates the Nepali financial market, has repeatedly issued the notice asking Nepali citizens not to engage in crypto and NFTs. It warns that those not complying with the notice are punishable by law.

The central bank notice also says cryptocurrencies and digital assets like NFTs are “purely based on speculation” and produce no returns.

For a small economy like Nepal, outflow of foreign currency remains a major concern. The central bank fears that allowing the citizens to engage in cryptocurrencies would put further strain on its depleting foreign currency reserves.

Citizens’ involvement in crypto and digital assets also severely limit a country’s ability to control the economy through various financial instruments. That would put an already vulnerable economy in a tight spot.